illinois electric car tax credit 2021

From July 1 st until the end of the year the credit is only worth 1875. Residential Federal Tax Credit Business Federal Tax Credit For Systems Installed.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

From 2020 you wont be able to claim tax credits on a Tesla.

. From April 2019 qualifying vehicles are only worth 3750 in tax credits. Illinois Will Pay Residents 4K to Buy an Electric Car. 15000 per networked DC fast charge DCFC station.

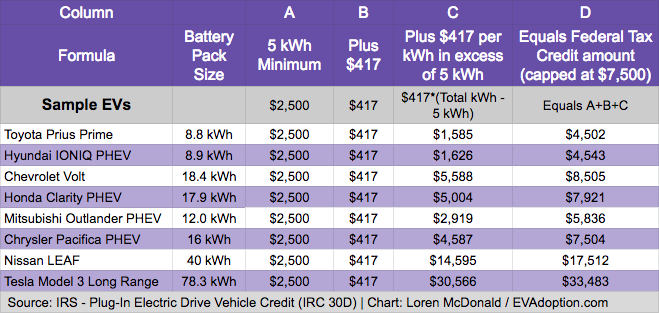

Illinois will give you 4000 for buying an electric car. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. 6000 per non-networked dual station.

Registration Fees for IL Electric Vehicles. Understanding electric vehicle tax credits for 2021 is a little complex but absolutely worth your time if youre serious about going electric. Learn more on this and how to obtain EV license plates below.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. Additionally Illinois offers larger rebates for dual and fast charge stations. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Updated March 2022. It looks like all of Illinois should be covered under the 4000 rebate but not until July 2022. The maximum total rebate award from the state is 50000.

ETron EV eTron Sportback EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley. Currently the federal government offers a 7500 tax credit when purchasing qualifying electric vehicles which could grow to 12500 if the federal government passes the 35 trillion social. General Motors became the second manufacturer to hit this milestone in the final financial quarter of 2018.

12500 per non-networked single station. This groundbreaking program is designed to bolster Illinois manufacturing already a top destination for electric vehicle EV manufacturing in the United States and to grow the ecosystem to create new capacity for EV vehicle and. The tax credit expires for each.

Visit FuelEconomygov for an insight into the types of tax credit available for specific models. A clean energy bill that just passed in the state of Illinois has set a goal of adding 1. 7500 per networked dual station.

Tax credits of up to 80 of the cost of EVSE to qualifying applicants. For light-duty medium-duty and heavy-duty electric trucks the credits are 7000 purchase3500 lease 10000 purchase5000 lease. The Illinois Secretary of State Vehicle Services Department offers specific vehicle registration fees to residents who drive an electric vehicle EV.

SPRINGFIELD Lawmakers were closing in on approving a package of tax credits and incentives meant to encourage the development of the electric vehicle industry in Illinois Thursday evening. Need service on your existing car. No emissions checks for all electric vehicles.

Beginning on January 1 2021. A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns.

The federal government also offers a 7500 tax credit for purchasers of electric vehicles excluding those manufactured by. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandonedThe EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The amount of credit you are entitled to depends on the battery capacity and size of the vehicle.

January 1 2023 to December 31 2023. Tesla cars bought after December 31 2021 would be eligible for. The federal government also offers a 7500 tax credit for purchasers of electric vehicles excluding those manufactured by Tesla and GM.

In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax. January 1 2020 to December 31 2022. In 2021 Governor JB Pritzker and the General Assembly passed the Reimagining Electric Vehicles in Illinois Act REV Illinois Act into law.

The rebate falls to 2000 in 2026 and 1000 in 2028. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

The federal government also offers a 7500 tax credit for purchasers of electric vehicles excluding those manufactured by Tesla and. On or after January 1 2024. Illinois vehicle registration fees for electric cars is 251 per registration.

Electric Cars Eligible for the Full 7500 Tax Credit Audi. As if people in Illinois werent being taxed enough as a result of the states ongoing pension crisis now electric vehicle owners in the lowest rated state are going to have to pay 248 in annual registration fees next year 100 more than what owners of gas burning cars pay according to the Chicago Tribune. How Much is the Electric Vehicle Tax Credit Worth.

Credit of 5000 of purchase or conversion and 2500 for a lease of light duty EVs or PHEVs. The maximum credit is 1000 per residential electric car charging station and 10000 for each public fueling station. A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500.

On the transportation front the new law offers a 4000 rebate for people buying electric cars starting in July. Vehicle Registration Fees for Illinois Electric Vehicles.

Rivian Electric Vehicle Maker Backed By Amazon And Ford Files S1 Ipo

Made Green Upgrades In 2021 Quick Start Guide To Energy Tax Credits

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Tesla Posts Sales Of Almost 1 Million Cars In 2021 News Dw 03 01 2022

Amazon Backed Rivian Hauls In Additional 2 65 Billion To Fund Electric Vehicle Push

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Electric Vehicles Should Be A Win For American Workers Center For American Progress

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

.jpg)

Latest On Tesla Ev Tax Credit March 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Reimagining Electric Vehicles Rev Illinois Program Rev

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Will Rivian S Electric Vehicles End Detroit S Reign Over The Us Auto Industry Electric Hybrid And Low Emission Cars The Guardian

Rebates And Tax Credits For Electric Vehicle Charging Stations

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek